Alexandra Pascalidou asks the question in today's Metro who will save Greece. If the news later today is to be believed, it sounded like the Germans and the French would help...I'm probably a bit too cynical to believe that any politician wants to give 400 billion dollars to another country's voters.

But a small part, more precisely 0.9% of the world's population, owns an awful lot yes the whole 39% of the world's assets according to a report by the Boston Consulting Group. Taste the numbers one more time and think where there is money to be found now that nations like Greece are having a bit of a sweat with the economy.

It is easy to point the finger at the PIIGS countries and think that they should behave because all the other pundits do. Mainstraem media gives its support to those who go hard for Greece. In reputable newspapers such as the Economist, it is written that the Greeks should be more like the Scandinavian countries.

During the lunch breaks we talk about the financial crisis and Greece during the news drought. Of course it is terrible that they can retire at the age of 50 and they are probably quite lazy in southern Europe too - not to mention their corrupt public sector where people are appointed on political grounds.

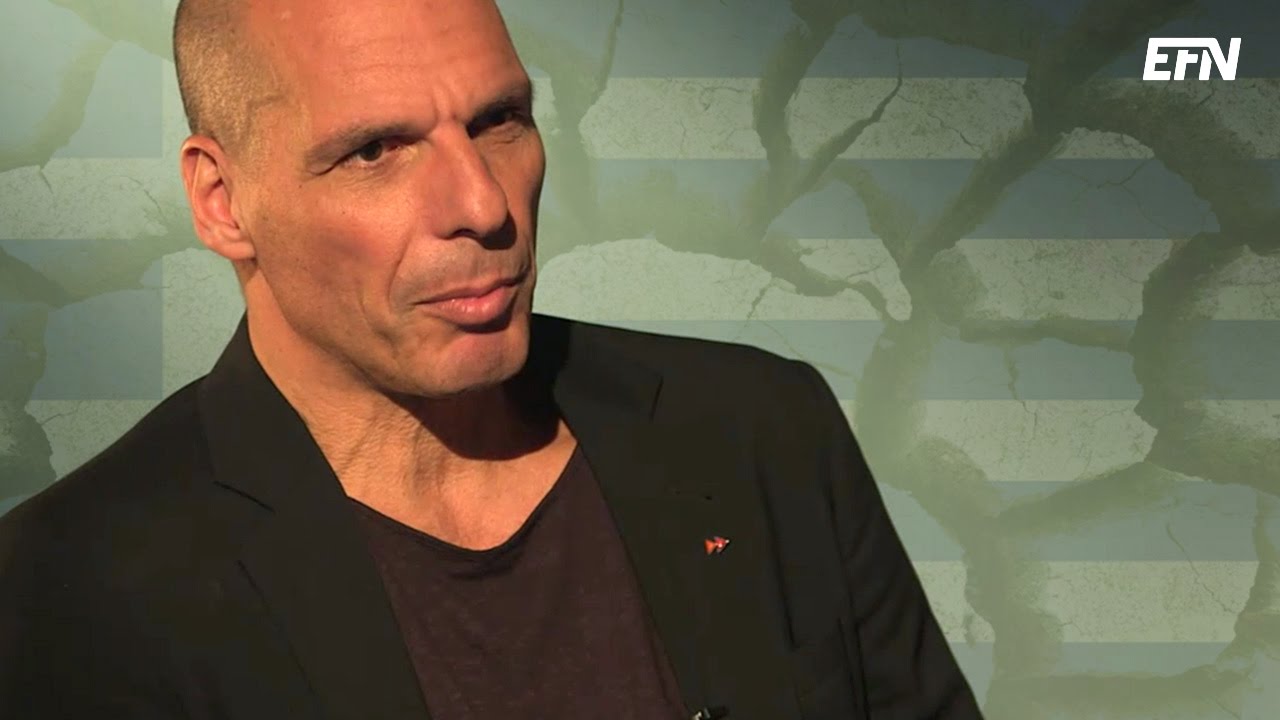

But of course this is pure bullshit. The Greeks are less than 12 million inhabitants and their soup depends on the interest rate, military equipment and the Euro. The problem with the so-called Greek crisis is that we are misled into directing our focus in the wrong direction. According to Yanis Varoufakis, the problem was the French and German banks that were bailed out and the price was paid by the Greek taxpayers. More market fundamentalism does not solve the problem.

The Greeks show how not to spend your money. For example, 6% of GDP went to war materials in 2009 according to an article in aljazeera. It is ok to spend money on war materials if you are a great power and can print money to finance the madness but for a small country like Greece it is devastating. The enemy that the Greeks feel threatened by and that motivates the rearmament is of course the NATO country Turkey – a future economic power in the south.

The financial crisis started in the USA and their gigantic budget deficit around the war in Iraq and the way they try to solve the financial crisis is called quantum easing. Why not focus on the 0.9% of the population, on the banksters and their assets - that's where the money is, after all?

By having Hitler explain the current state of the world economy, I think this video becomes quite subtle even if it is a few years old. The fashion word of the day is quantum easing i.e. a nicer expression for printing dollar bills.

When I studied economics, it was important to keep the current account balance and unemployment in check, but that no longer applies. Aligned finance ministers are praised if they reduce their costs in the public sector while printing more money in countries with large budget deficits. To quote George Soros in his book The Crisis of Global Capitalism pp. 145f-"By definition, it is the center that provides the capital and the periphery that is the recipient. An abrupt change in the center's willingness to provide capital to the periphery can cause major disruptions in recipient countries….Usually all forms of capital move in the same direction". Then Soros continues that there are many countries that have failed to pay their debt and during the financial crisis of 1982 the Paris Club was created for government debts….

The money is plowed into the banking systems where it disappears in the form of bonuses, tax havens and offshore private banking - instead of the money going back and acting as fuel in the economy. At the moment, there is asymmetry between the lending banks and the borrowing countries, to use George Soros's terminology.

In our immediate area, we have the insane lending from Swedish banks to the Baltic countries and the housing market where Swedish banks act as lenders. Sweden is a small country, but the paradigm shift in private finance is that we must all borrow and private individuals must be monitored. Nothing is said about the price that citizens pay. Nowhere does it say that our healthcare has capsized and we get worse and worse care if we don't have private health insurance - but 0.9% of the world's population is getting richer and richer.

The solution is transparency on the financial market and around military costs and tighter regulation and monitoring of banks' lending. It should also be prohibited for banks to run other business areas such as services in the housing market and private banking.