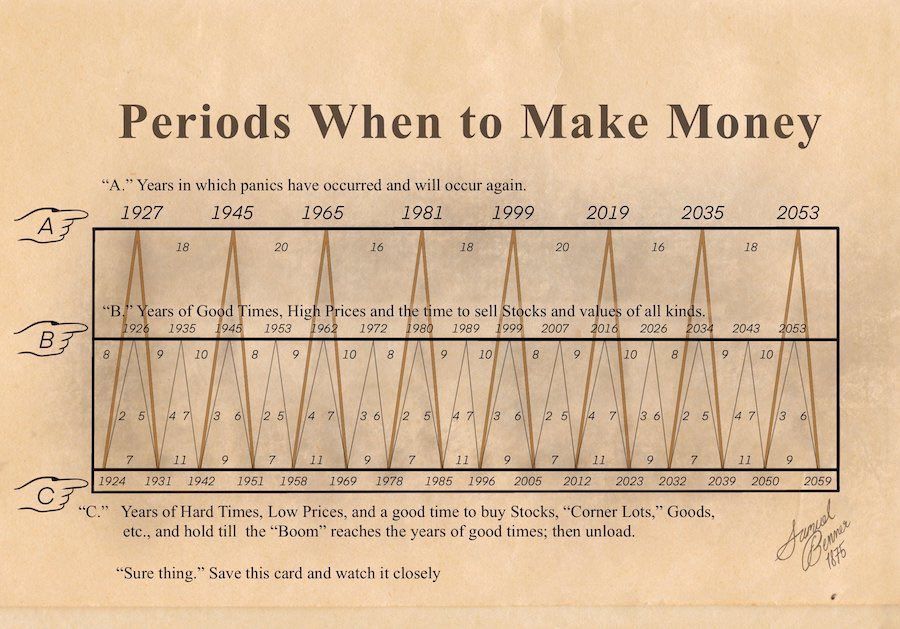

The Benner Cycle, which is over 150 years old, is an economic theory developed by Samuel Benner, an American businessman and farmer. This theory suggests that there is a recurring pattern in financial markets and the economy that spans a period of 21 years, consisting of eight years of rising prices followed by thirteen years of more mixed results. This cycle is claimed to have the ability to predict price movements in agricultural products, as well as more generally economic booms and busts.

Panic year: These are years when the market panicked, either buying or selling a stock irrationally until its price soared or plummeted beyond everyone's wildest expectations.

Good times: Years that Benner identified as times of high prices and the best time to sell stocks, values and assets of all kinds.

Hard times: During these years, Benner recommends buying stocks, commodities and assets and holding them until the "boom" years of good times.

Benner based his cycle on observations of price movements in the 19th century, particularly in the agricultural sector. He believed that this cycle could be used to predict future price movements and economic trends. However, it is important to note that many economists and financial analysts are skeptical of Benner's theory, as it has no scientific basis and its predictions often do not match actual economic developments.